BrightView Reports Fourth Quarter and Full Year Fiscal 2018 Results

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the fourth quarter and full fiscal year ended September 30, 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181127005818/en/

(Graphic: Business Wire)

Fourth Quarter Fiscal 2018 Highlights

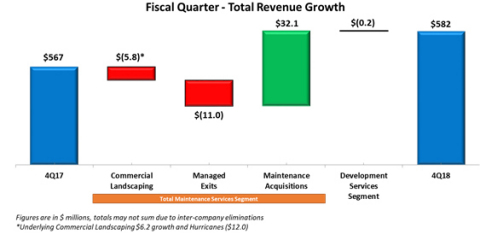

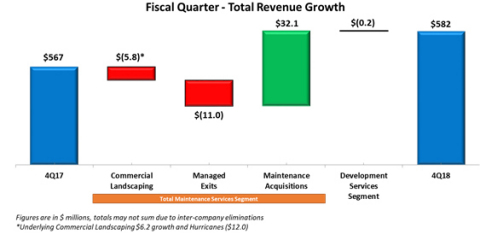

- Total revenues for the quarter increased 2.6% versus the prior year quarter, totaling $581.8 million, with 3.5% higher Maintenance Services Segment revenues and flat Development Services Segment revenues;

- Net loss of $10.9 million, or ($0.11) per share, compared to net income of $0.4 million in the prior year quarter;

- Adjusted EBITDA increased 5.6% to $84.2 million, with a 40 bps Adjusted EBITDA margin improvement to 14.5%;

- Adjusted Net Income increased 48.2% to $35.8 million, or $0.35 per share;

- Extended and amended the Company’s long-term Credit Facilities.

Full Year Fiscal 2018 Highlights

- Total revenues in 2018 increased 5.7% versus the prior year, totaling a record $2,353.6 million, with 7.4% higher Maintenance Services Segment and 1.1% higher Development Services Segment revenues;

- Net loss of $15.1 million, or ($0.18) per share, compared to net loss of $37.4 million in 2017;

- Adjusted EBITDA increased 12.6% to $300.1 million, with an 80 bps Adjusted EBITDA margin improvement to 12.8%;

- Adjusted Net Income increased 54.8% to $90.0 million, or $1.08 per share;

- Net Cash Provided by Operating Activities increased by $56.2 million to $180.4 million and Adjusted Free Cash Flow increased by $57.2 million to $127.6 million;

- Completed five acquisitions with an estimated $117.6 million of aggregate annualized revenue, for aggregate consideration of $104.4 million, net of cash.

“I am very pleased with the progress we made last year to support sustainable topline growth, capture efficiencies in our cost structure and generate substantial adjusted free cash flow. We delivered the highest revenue and profitability in our history, meaningfully reduced our balance sheet leverage, and successfully completed our IPO. Moving forward now as a public company, we will remain focused on growing our existing customer relationships, continuing our 'strong on strong’ acquisition strategy, and driving further cash flow generation,” said Andrew Masterman, BrightView Chief Executive Officer. “As we begin our 2019 fiscal year, industry trends remain favorable, our acquisition pipeline is strong, and I am confident that we have the right strategy in place to create significant stockholder value as we continue consolidating our position as the Nation’s Landscaper.”

Unless indicated otherwise, the information in this release has been adjusted to give effect to a 2.33839-for-one reverse stock split of the Company’s common stock effected on June 8, 2018. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Free Cash Flow and Adjusted Earnings per Share are non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” sections for more information.

Fiscal 2018 Results – Total BrightView

| Total BrightView - Operating Highlights | ||||||||||||||||||

| Three Months Ended September 30, | Twelve Months Ended September 30, | |||||||||||||||||

| ($ in millions, except per share figures) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||

| Total Revenue | $581.8 | $567.0 | 2.6% | $2,353.6 | $2,225.9 | 5.7% | ||||||||||||

| Net (loss) income | ($10.9) | $0.4 | nm | ($15.1) | ($37.4) | nm | ||||||||||||

| Adjusted EBITDA | $84.2 | $79.7 | 5.6% | $300.1 | $266.6 | 12.6% | ||||||||||||

| Adjusted EBITDA Margin | 14.5% | 14.1% | 40 bps | 12.8% | 12.0% | 80 bps | ||||||||||||

| Adjusted Net Income | $35.8 | $24.2 | 48.2% | $90.0 | $58.1 | 54.8% | ||||||||||||

| Earnings per Share, GAAP | ($0.11) | $0.01 | nm | ($0.18) | ($0.49) | nm | ||||||||||||

| Earnings per Share, Adjusted | $0.35 | $0.31 | 12.9% | $1.08 | $0.75 | 44.0% | ||||||||||||

For the fourth quarter fiscal 2018, total revenue increased 2.6% to $581.8 million due to growth in the Maintenance Services Segment and flat Development Services Segment revenue. Total Adjusted EBITDA grew 5.6% driven by higher revenues, increased profitability in both segments and efficiencies captured in SG&A.

For fiscal 2018, total revenue increased 5.7% to $2,353.6 million supported by growth in both the Maintenance Services Segment and Development Services Segment revenues. Total Adjusted EBITDA was $300.1 million, up 12.6% versus the prior year, driven by higher revenues, improved profitability in the Maintenance Services Segment and efficiencies captured in SG&A.

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the fourth quarter and full fiscal year ended September 30, 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181127005818/en/

(Graphic: Business Wire)

Fourth Quarter Fiscal 2018 Highlights

- Total revenues for the quarter increased 2.6% versus the prior year quarter, totaling $581.8 million, with 3.5% higher Maintenance Services Segment revenues and flat Development Services Segment revenues;

- Net loss of $10.9 million, or ($0.11) per share, compared to net income of $0.4 million in the prior year quarter;

- Adjusted EBITDA increased 5.6% to $84.2 million, with a 40 bps Adjusted EBITDA margin improvement to 14.5%;

- Adjusted Net Income increased 48.2% to $35.8 million, or $0.35 per share;

- Extended and amended the Company’s long-term Credit Facilities.

Full Year Fiscal 2018 Highlights

- Total revenues in 2018 increased 5.7% versus the prior year, totaling a record $2,353.6 million, with 7.4% higher Maintenance Services Segment and 1.1% higher Development Services Segment revenues;

- Net loss of $15.1 million, or ($0.18) per share, compared to net loss of $37.4 million in 2017;

- Adjusted EBITDA increased 12.6% to $300.1 million, with an 80 bps Adjusted EBITDA margin improvement to 12.8%;

- Adjusted Net Income increased 54.8% to $90.0 million, or $1.08 per share;

- Net Cash Provided by Operating Activities increased by $56.2 million to $180.4 million and Adjusted Free Cash Flow increased by $57.2 million to $127.6 million;

- Completed five acquisitions with an estimated $117.6 million of aggregate annualized revenue, for aggregate consideration of $104.4 million, net of cash.

“I am very pleased with the progress we made last year to support sustainable topline growth, capture efficiencies in our cost structure and generate substantial adjusted free cash flow. We delivered the highest revenue and profitability in our history, meaningfully reduced our balance sheet leverage, and successfully completed our IPO. Moving forward now as a public company, we will remain focused on growing our existing customer relationships, continuing our 'strong on strong’ acquisition strategy, and driving further cash flow generation,” said Andrew Masterman, BrightView Chief Executive Officer. “As we begin our 2019 fiscal year, industry trends remain favorable, our acquisition pipeline is strong, and I am confident that we have the right strategy in place to create significant stockholder value as we continue consolidating our position as the Nation’s Landscaper.”

Unless indicated otherwise, the information in this release has been adjusted to give effect to a 2.33839-for-one reverse stock split of the Company’s common stock effected on June 8, 2018. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Free Cash Flow and Adjusted Earnings per Share are non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” sections for more information.

Fiscal 2018 Results – Total BrightView

| Total BrightView - Operating Highlights | ||||||||||||||||||

| Three Months Ended September 30, | Twelve Months Ended September 30, | |||||||||||||||||

| ($ in millions, except per share figures) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||

| Total Revenue | $581.8 | $567.0 | 2.6% | $2,353.6 | $2,225.9 | 5.7% | ||||||||||||

| Net (loss) income | ($10.9) | $0.4 | nm | ($15.1) | ($37.4) | nm | ||||||||||||

| Adjusted EBITDA | $84.2 | $79.7 | 5.6% | $300.1 | $266.6 | 12.6% | ||||||||||||

| Adjusted EBITDA Margin | 14.5% | 14.1% | 40 bps | 12.8% | 12.0% | 80 bps | ||||||||||||

| Adjusted Net Income | $35.8 | $24.2 | 48.2% | $90.0 | $58.1 | 54.8% | ||||||||||||

| Earnings per Share, GAAP | ($0.11) | $0.01 | nm | ($0.18) | ($0.49) | nm | ||||||||||||

| Earnings per Share, Adjusted | $0.35 | $0.31 | 12.9% | $1.08 | $0.75 | 44.0% | ||||||||||||

For the fourth quarter fiscal 2018, total revenue increased 2.6% to $581.8 million due to growth in the Maintenance Services Segment and flat Development Services Segment revenue. Total Adjusted EBITDA grew 5.6% driven by higher revenues, increased profitability in both segments and efficiencies captured in SG&A.

For fiscal 2018, total revenue increased 5.7% to $2,353.6 million supported by growth in both the Maintenance Services Segment and Development Services Segment revenues. Total Adjusted EBITDA was $300.1 million, up 12.6% versus the prior year, driven by higher revenues, improved profitability in the Maintenance Services Segment and efficiencies captured in SG&A.

Fiscal 2018 Results – Segments

| Maintenance Services Segment - Operating Highlights | ||||||||||||||||||

| Three Months Ended September 30, | Twelve Months Ended September 30, | |||||||||||||||||

| ($ in millions) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||

| Landscape Maintenance Services | $433.7 | $418.4 | 3.7% | $1,522.5 | $1,458.9 | 4.4% | ||||||||||||

| Snow Removal Services | ($0.3) | $0.2 | nm | $252.3 | $192.9 | 30.8% | ||||||||||||

| Total Segment Revenue | $433.4 | $418.6 | 3.5% | $1,774.8 | $1,651.8 | 7.4% | ||||||||||||

| Adjusted EBITDA | $79.6 | $76.8 | 3.5% | $289.8 | $258.0 | 12.3% | ||||||||||||

| Adjusted EBITDA Margin | 18.4% | 18.4% | 0 bps | 16.3% | 15.6% | 70 bps | ||||||||||||

| Capital Expenditures | $11.8 | $6.6 | 79.8% | $45.5 | $47.4 | (3.8%) | ||||||||||||

For the fourth quarter fiscal 2018, revenue in the Maintenance Services Segment rose 3.5% to $433.4 million. Landscape Maintenance Services revenue rose 3.7%, driving the segment’s revenue growth. Acquisitions added 7.7% but were partially offset by a 4.0% negative revenue contribution from commercial landscaping. Within this decline, underlying commercial landscaping contributed 1.5% to growth with offsetting impacts of 2.9%, from a difficult comparison with the revenue related to Hurricane Irma clean-up in the fourth quarter of 2017, and 2.6%, from Managed Exits as the Company strategically reduced the number of less profitable accounts established in previous years.

Adjusted EBITDA for the Maintenance Services Segment in the quarter increased 3.5% to $79.6 million, with the Adjusted EBITDA margin remaining flat versus the prior year quarter.

For full year fiscal 2018, revenue for the Maintenance Services Segment increased 7.4% to $1,774.8 million, with Landscape Maintenance Services revenue 4.4% higher and Snow Removal Services revenue, compared with a far-below-average prior year, up 30.8%. Acquired businesses added 6.6% to the growth of Landscape Maintenance Services revenue, while commercial landscaping reduced growth by 2.2%. The decline in commercial landscaping revenue was mostly due to the strategic Managed Exits initiative, which reduced revenue by 1.6%. The balance of the decline was largely due to an early-year loss in the Company’s national accounts portfolio. The timing of Hurricane Irma in September and October of 2017 caused it to generate similar revenue in consecutive quarters over two different fiscal years. As a result, the quarterly comparisons versus the prior year created a variance but the full-year comparison was muted.

Adjusted EBITDA for the Maintenance Services Segment in fiscal 2018 increased 12.3% to $289.8 million, with an Adjusted EBITDA margin expansion of 70 basis points to 16.3%.

| Development Services Segment - Operating Highlights | ||||||||||||||||||

| Three Months Ended September 30, | Twelve Months Ended September 30, | |||||||||||||||||

| ($ in millions) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||

| Total Segment Revenue | $149.7 | $149.9 | (0.1%) | $583.3 | $577.2 | 1.1% | ||||||||||||

| Adjusted EBITDA | $23.4 | $18.0 | 30.0% | $78.7 | $77.4 | 1.7% | ||||||||||||

| Adjusted EBITDA Margin | 15.7% | 12.0% | 370 bps | 13.5% | 13.4% | 10 bps | ||||||||||||

| Capital Expenditures | $0.9 | $1.9 | (50.5%) | $4.9 | $6.2 | (21.7%) | ||||||||||||

Revenues for the Development Services Segment were relatively flat at $149.7 million for the fourth quarter fiscal 2018. New project revenue and project revenue derived from Maintenance Services acquisitions contributed to offset a comparison with the timing of work performed on certain large projects in the prior year period.

Adjusted EBITDA for the Development Services Segment increased 30% to $23.4 million in the quarter, benefitting from the substantial completion of certain large lower margin projects that impacted the prior year quarter.

Revenue in the Development Services Segment increased 1.1% to $583.3 million for fiscal 2018, driven by $7.2 million in project revenue derived from Maintenance Services acquisitions. Revenue from new projects in fiscal 2018 largely offset the revenue generated by certain large projects in the prior year.

Adjusted EBITDA in the Development Services Segment increased 1.7% to $78.7 million for fiscal 2018. Segment Adjusted EBITDA Margin was 13.5%, or relatively flat compared to the prior year.

| Total BrightView Cash Flow and Balance Sheet Metrics | |||||||||

| Twelve Months Ended September 30, | |||||||||

| ($ in millions) | 2018 | 2017 | Change | ||||||

| Cash Provided by Operating Activities | $180.4 | $124.2 | 45.2% | ||||||

| Adjusted Free Cash Flow | $127.6 | $70.4 | 81.2% | ||||||

| Capital Expenditures | $86.4 | $60.9 | 41.9% | ||||||

| Total Financial Debt1 | $1,184.4 | $1,639.7 | (27.8%) | ||||||

| Total Cash & Equivalents | $35.2 | $12.8 | 175.6% | ||||||

| Net Debt2 to Adjusted EBITDA ratio | 3.8x | 6.1x | -2.3x | ||||||

1Total Financial Debt equals total long term debt, less original issue discount, plus the present value of net minimum lease payments under capital lease obligations.

2 Net Debt equals Total Financial Debt minus Total Cash & Equivalents

Net cash provided by operating activities for the twelve months ended September 30, 2018 was $180.4 million, compared to $124.2 million for the prior year. Adjusted Free Cash Flow for the year ended September 30, 2018 was $127.6 million, an increase in cash generation of $57.2 million over the prior year. The increases are reflective of higher operating cash flows and improvements in working capital management.

For fiscal 2018, capital expenditures were $86.4 million, compared with $60.9 million last year, driven by the purchase of legacy ValleyCrest facilities for $21.6 million in October 2017. The Company also generated proceeds from the sale of property and equipment of $12.0 million and $7.0 million in 2018 and 2017, respectively. Net of the legacy asset purchase in 2018 and the proceeds from the sale of property and equipment in each year, capital expenditures represented 2.2% and 2.4% of revenue in 2018 and 2017, respectively.

As of September 30, 2018, the Company’s Net Debt2 was $1.15 billion, a reduction of $478 million compared to $1.63 billion at the prior year end. Combined with higher Adjusted EBITDA generation for the fiscal year, the change in the Company’s net debt led to a Net Debt to Adjusted EBITDA ratio of 3.8x as of September 30, 2018.

In connection with the Company’s term loan repayments during the fourth quarter of fiscal 2018, the Company incurred non-cash losses on debt extinguishment of $25.1 million in the period. These non-cash losses, which are included in the “Other (Expense) Income” line of the income statement, arose from the accelerated amortization of deferred financing fees and the original issue discount.

2019 Fiscal Year Outlook

For the full year fiscal 2019, BrightView is providing the following guidance:

- Total Revenue of between $2,400 million and $2,470 million;

- Adjusted EBITDA of between $310 million and $318 million;

- Managed Exits of $15 to $25 million in revenue, declining over the course of the fiscal year;

- Net Capital Expenditures of approximately 2.5% of revenue.

Although the first quarter of 2019 faces a comparison of $17.5 million in hurricane clean-up revenue in the prior-year first quarter (including $4.0 million from acquired businesses), underlying trends in the industry are expected to remain positive for the 2019 fiscal year, supporting topline growth in the Company’s existing footprint as well as a robust acquisition pipeline for the year. BrightView plans to continue its strategic approach to pricing, service enhancements, customer retention, new business development and “strong on strong” acquisitions. Finally, the Company will work to identify additional opportunities to leverage its SG&A and Corporate expenses in order to further expand operating margins.

The Company is not providing a quantitative reconciliation of our financial outlook for Adjusted EBITDA to net income (loss), its corresponding GAAP measure, because the GAAP measure that we exclude from our non-GAAP financial outlook is difficult to reliably predict or estimate without unreasonable effort due to its dependence on future uncertainties, such as items discussed below under the heading “Non-GAAP Financial Measures.” Additionally, information that is currently not available to the Company could have a potentially unpredictable and potentially significant impact on its future GAAP financial results.

Recent Developments

California Wildfires

As of the date of this release, the devastating wildfires in both Northern and Southern California that began during the month of November 2018, have not caused material damage to either the Company’s office in Calabasas, CA, or its branch offices in the state. The Company is monitoring the situation but does not currently expect the wildfires to have a material impact on its employees, revenue stream or cost structure moving forward.

Daniel Schleiniger Appointed Vice President of Investor Relations

Daniel Schleiniger joined BrightView at the end of October 2018 as the new Vice President of Investor Relations, reporting to John Feenan, BrightView’s Chief Financial Officer. Dan’s most recent position, prior to joining BrightView, was VP of Corporate Communications and Investor Relations for Arcos Dorados (NYSE: ARCO). His career includes broad international experience across a number of finance functions including equity research, investor relations, financial planning and analysis as well as treasury and portfolio management. Dan holds a Bachelor of Science degree in chemistry from the University of Delaware and an MBA in Finance from the same institution. He will be based in BrightView’s Plymouth Meeting, PA headquarters.

Revised Fiscal Calendar

The Company revised its fiscal year end from December 31 to September 30 of each year, beginning with September 30, 2017. The period from January 1, 2017 through September 30, 2017 was recorded as a transition period. Year-over-year comparisons of annual financial results included in this press release and the attached financial tables compare results for BrightView’s full fiscal year 2018 (October 1, 2017 through September 30, 2018) to the Company’s twelve months ended September 30, 2017 (October 1, 2016 through September 30, 2017).

Conference Call Information

A conference call to discuss the fourth quarter and fiscal 2018 financial results is scheduled for November 28, 2018, at 10 a.m. Eastern Standard Time. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 5667795. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where presentation materials will be posted prior to the call.

A telephone replay will be available shortly after the broadcast through Dec 16, 2018, by dialing 800-585-8367 from the U.S., and entering conference passcode 5667795. A replay of the audio webcast also will be archived on the Company’s investor website.

| Maintenance Services Segment - Operating Highlights | ||||||||||||||||||

| Three Months Ended September 30, | Twelve Months Ended September 30, | |||||||||||||||||

| ($ in millions) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||

| Landscape Maintenance Services | $433.7 | $418.4 | 3.7% | $1,522.5 | $1,458.9 | 4.4% | ||||||||||||

| Snow Removal Services | ($0.3) | $0.2 | nm | $252.3 | $192.9 | 30.8% | ||||||||||||

| Total Segment Revenue | $433.4 | $418.6 | 3.5% | $1,774.8 | $1,651.8 | 7.4% | ||||||||||||

| Adjusted EBITDA | $79.6 | $76.8 | 3.5% | $289.8 | $258.0 | 12.3% | ||||||||||||

| Adjusted EBITDA Margin | 18.4% | 18.4% | 0 bps | 16.3% | 15.6% | 70 bps | ||||||||||||

| Capital Expenditures | $11.8 | $6.6 | 79.8% | $45.5 | $47.4 | (3.8%) | ||||||||||||

For the fourth quarter fiscal 2018, revenue in the Maintenance Services Segment rose 3.5% to $433.4 million. Landscape Maintenance Services revenue rose 3.7%, driving the segment’s revenue growth. Acquisitions added 7.7% but were partially offset by a 4.0% negative revenue contribution from commercial landscaping. Within this decline, underlying commercial landscaping contributed 1.5% to growth with offsetting impacts of 2.9%, from a difficult comparison with the revenue related to Hurricane Irma clean-up in the fourth quarter of 2017, and 2.6%, from Managed Exits as the Company strategically reduced the number of less profitable accounts established in previous years.

Adjusted EBITDA for the Maintenance Services Segment in the quarter increased 3.5% to $79.6 million, with the Adjusted EBITDA margin remaining flat versus the prior year quarter.

For full year fiscal 2018, revenue for the Maintenance Services Segment increased 7.4% to $1,774.8 million, with Landscape Maintenance Services revenue 4.4% higher and Snow Removal Services revenue, compared with a far-below-average prior year, up 30.8%. Acquired businesses added 6.6% to the growth of Landscape Maintenance Services revenue, while commercial landscaping reduced growth by 2.2%. The decline in commercial landscaping revenue was mostly due to the strategic Managed Exits initiative, which reduced revenue by 1.6%. The balance of the decline was largely due to an early-year loss in the Company’s national accounts portfolio. The timing of Hurricane Irma in September and October of 2017 caused it to generate similar revenue in consecutive quarters over two different fiscal years. As a result, the quarterly comparisons versus the prior year created a variance but the full-year comparison was muted.

Adjusted EBITDA for the Maintenance Services Segment in fiscal 2018 increased 12.3% to $289.8 million, with an Adjusted EBITDA margin expansion of 70 basis points to 16.3%.

| Development Services Segment - Operating Highlights | ||||||||||||||||||

| Three Months Ended September 30, | Twelve Months Ended September 30, | |||||||||||||||||

| ($ in millions) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||

| Total Segment Revenue | $149.7 | $149.9 | (0.1%) | $583.3 | $577.2 | 1.1% | ||||||||||||

| Adjusted EBITDA | $23.4 | $18.0 | 30.0% | $78.7 | $77.4 | 1.7% | ||||||||||||

| Adjusted EBITDA Margin | 15.7% | 12.0% | 370 bps | 13.5% | 13.4% | 10 bps | ||||||||||||

| Capital Expenditures | $0.9 | $1.9 | (50.5%) | $4.9 | $6.2 | (21.7%) | ||||||||||||

Revenues for the Development Services Segment were relatively flat at $149.7 million for the fourth quarter fiscal 2018. New project revenue and project revenue derived from Maintenance Services acquisitions contributed to offset a comparison with the timing of work performed on certain large projects in the prior year period.

Adjusted EBITDA for the Development Services Segment increased 30% to $23.4 million in the quarter, benefitting from the substantial completion of certain large lower margin projects that impacted the prior year quarter.

Revenue in the Development Services Segment increased 1.1% to $583.3 million for fiscal 2018, driven by $7.2 million in project revenue derived from Maintenance Services acquisitions. Revenue from new projects in fiscal 2018 largely offset the revenue generated by certain large projects in the prior year.

Adjusted EBITDA in the Development Services Segment increased 1.7% to $78.7 million for fiscal 2018. Segment Adjusted EBITDA Margin was 13.5%, or relatively flat compared to the prior year.

| Total BrightView Cash Flow and Balance Sheet Metrics | |||||||||

| Twelve Months Ended September 30, | |||||||||

| ($ in millions) | 2018 | 2017 | Change | ||||||

| Cash Provided by Operating Activities | $180.4 | $124.2 | 45.2% | ||||||

| Adjusted Free Cash Flow | $127.6 | $70.4 | 81.2% | ||||||

| Capital Expenditures | $86.4 | $60.9 | 41.9% | ||||||

| Total Financial Debt1 | $1,184.4 | $1,639.7 | (27.8%) | ||||||

| Total Cash & Equivalents | $35.2 | $12.8 | 175.6% | ||||||

| Net Debt2 to Adjusted EBITDA ratio | 3.8x | 6.1x | -2.3x | ||||||

1Total Financial Debt equals total long term debt, less original issue discount, plus the present value of net minimum lease payments under capital lease obligations.

2 Net Debt equals Total Financial Debt minus Total Cash & Equivalents

Net cash provided by operating activities for the twelve months ended September 30, 2018 was $180.4 million, compared to $124.2 million for the prior year. Adjusted Free Cash Flow for the year ended September 30, 2018 was $127.6 million, an increase in cash generation of $57.2 million over the prior year. The increases are reflective of higher operating cash flows and improvements in working capital management.

For fiscal 2018, capital expenditures were $86.4 million, compared with $60.9 million last year, driven by the purchase of legacy ValleyCrest facilities for $21.6 million in October 2017. The Company also generated proceeds from the sale of property and equipment of $12.0 million and $7.0 million in 2018 and 2017, respectively. Net of the legacy asset purchase in 2018 and the proceeds from the sale of property and equipment in each year, capital expenditures represented 2.2% and 2.4% of revenue in 2018 and 2017, respectively.

As of September 30, 2018, the Company’s Net Debt2 was $1.15 billion, a reduction of $478 million compared to $1.63 billion at the prior year end. Combined with higher Adjusted EBITDA generation for the fiscal year, the change in the Company’s net debt led to a Net Debt to Adjusted EBITDA ratio of 3.8x as of September 30, 2018.

In connection with the Company’s term loan repayments during the fourth quarter of fiscal 2018, the Company incurred non-cash losses on debt extinguishment of $25.1 million in the period. These non-cash losses, which are included in the “Other (Expense) Income” line of the income statement, arose from the accelerated amortization of deferred financing fees and the original issue discount.

2019 Fiscal Year Outlook

For the full year fiscal 2019, BrightView is providing the following guidance:

- Total Revenue of between $2,400 million and $2,470 million;

- Adjusted EBITDA of between $310 million and $318 million;

- Managed Exits of $15 to $25 million in revenue, declining over the course of the fiscal year;

- Net Capital Expenditures of approximately 2.5% of revenue.

Although the first quarter of 2019 faces a comparison of $17.5 million in hurricane clean-up revenue in the prior-year first quarter (including $4.0 million from acquired businesses), underlying trends in the industry are expected to remain positive for the 2019 fiscal year, supporting topline growth in the Company’s existing footprint as well as a robust acquisition pipeline for the year. BrightView plans to continue its strategic approach to pricing, service enhancements, customer retention, new business development and “strong on strong” acquisitions. Finally, the Company will work to identify additional opportunities to leverage its SG&A and Corporate expenses in order to further expand operating margins.

The Company is not providing a quantitative reconciliation of our financial outlook for Adjusted EBITDA to net income (loss), its corresponding GAAP measure, because the GAAP measure that we exclude from our non-GAAP financial outlook is difficult to reliably predict or estimate without unreasonable effort due to its dependence on future uncertainties, such as items discussed below under the heading “Non-GAAP Financial Measures.” Additionally, information that is currently not available to the Company could have a potentially unpredictable and potentially significant impact on its future GAAP financial results.

Recent Developments

California Wildfires

As of the date of this release, the devastating wildfires in both Northern and Southern California that began during the month of November 2018, have not caused material damage to either the Company’s office in Calabasas, CA, or its branch offices in the state. The Company is monitoring the situation but does not currently expect the wildfires to have a material impact on its employees, revenue stream or cost structure moving forward.

Daniel Schleiniger Appointed Vice President of Investor Relations

Daniel Schleiniger joined BrightView at the end of October 2018 as the new Vice President of Investor Relations, reporting to John Feenan, BrightView’s Chief Financial Officer. Dan’s most recent position, prior to joining BrightView, was VP of Corporate Communications and Investor Relations for Arcos Dorados (NYSE: ARCO). His career includes broad international experience across a number of finance functions including equity research, investor relations, financial planning and analysis as well as treasury and portfolio management. Dan holds a Bachelor of Science degree in chemistry from the University of Delaware and an MBA in Finance from the same institution. He will be based in BrightView’s Plymouth Meeting, PA headquarters.

Revised Fiscal Calendar

The Company revised its fiscal year end from December 31 to September 30 of each year, beginning with September 30, 2017. The period from January 1, 2017 through September 30, 2017 was recorded as a transition period. Year-over-year comparisons of annual financial results included in this press release and the attached financial tables compare results for BrightView’s full fiscal year 2018 (October 1, 2017 through September 30, 2018) to the Company’s twelve months ended September 30, 2017 (October 1, 2016 through September 30, 2017).

Conference Call Information

A conference call to discuss the fourth quarter and fiscal 2018 financial results is scheduled for November 28, 2018, at 10 a.m. Eastern Standard Time. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 5667795. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where presentation materials will be posted prior to the call.

A telephone replay will be available shortly after the broadcast through Dec 16, 2018, by dialing 800-585-8367 from the U.S., and entering conference passcode 5667795. A replay of the audio webcast also will be archived on the Company’s investor website.

About BrightView:

BrightView (NYSE: BV), the nation’s largest commercial landscaper, proudly designs, creates, and maintains the best landscapes on Earth and provides the most efficient and comprehensive snow and ice removal services. With a dependable service commitment, BrightView brings brilliant landscapes to life at premier properties across the United States, including business parks and corporate offices, homeowners' associations, healthcare facilities, educational institutions, retail centers, resorts and theme parks, municipalities, golf courses, and sports venues. BrightView also serves as the Official Field Consultant to Major League Baseball. Through industry-leading best practices and sustainable solutions, BrightView is invested in taking care of our team members, engaging our clients, inspiring our communities, and preserving our planet. Visit www.BrightView.com and connect with us on X (formerly Twitter), Facebook, and LinkedIn.

For more information and/or permission to use BrightView images and assets, please send all media inquiries to communications@brightview.com