BrightView Reports Second Quarter Fiscal 2019 Results

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the second quarter ended March 31, 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190508005140/en/

(Graphic: Business Wire)

Second Quarter Fiscal 2019 Highlights

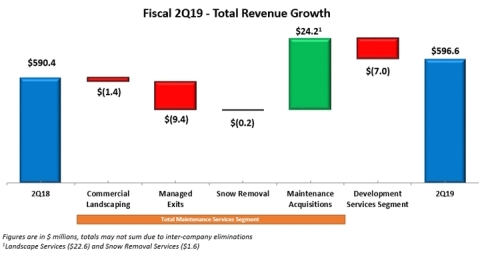

- Total Revenues for the quarter totaled $596.6 million, a 1.1% increase versus the prior year quarter, with 2.9% higher Maintenance Services Segment revenues and 5.4% lower Development Services Segment revenues;

- Net Loss of $3.6 million, or ($0.04) per share, and a net loss margin of 0.6%, compared to Net Loss of $22.1 million, or ($0.29) per share, and a net loss margin of 3.7%, in the prior year quarter;

- Adjusted EBITDA of $61.1 million, or 18.4% growth over the prior year quarter, with an Adjusted EBITDA margin of 10.2%, both of which were among the highest ever for the March quarter;

- Adjusted Net Income of $15.6 million, or $0.15 per share, compared to Adjusted Net Income of $7.6 million, or $0.10 per share, in the prior year quarter.

Six Months Fiscal 2019 Highlights

- Total Revenues for the six months totaled $1,122.7 million, a 1.6% decline versus the prior year period, with nearly flat Maintenance Services Segment revenues and 6.5% lower Development Services Segment revenues;

- Net Loss of $12.4 million, or ($0.12) per share, and a net loss margin of 1.1%, compared to Net Loss of $2.7 million, or ($0.04) per share, and a net loss margin of 0.2%, in the prior year period;

- Adjusted EBITDA of $111.2 million, or 5.8% below the prior year period, with an Adjusted EBITDA margin of 9.9%;

- Adjusted Net Income of $26.0 million, or $0.25 per share, compared to Adjusted Net Income of $21.0 million, or $0.27 per share, in the prior year period.

“Strong Maintenance Segment revenue and profitability highlighted our second quarter results and drove growth at the consolidated level. In fact, we delivered one of our best ever March quarters, with notable performance in Adjusted EBITDA and Adjusted EBITDA margin. In addition to gains in our Maintenance business, the quarter included lower corporate expenses, and more normalized levels of snowfall,” said Andrew Masterman, BrightView President and Chief Executive Officer. “With the beginning of the ‘green’ season, we’re pleased with the trends in our Maintenance landscape revenue and have built a robust book of business for the remainder of the fiscal year in our Development Segment. We remain confident in our full-year outlook and are maintaining our guidance ranges for both total revenue and Adjusted EBITDA for the full-year fiscal 2019.”

Fiscal 2019 Results – Total BrightView

| Total BrightView - Operating Highlights | |||||||||||||||||||||||||

| Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||||||||||||

| ($ in millions, except per share figures) | 2019 | 2018 | Change | 2019 | 2018 | Change | |||||||||||||||||||

| Revenue | $ | 596.6 | $ | 590.4 | 1.1% | $ | 1,122.7 | $ | 1,141.5 | (1.6%) | |||||||||||||||

| Net (loss) income | $ | (3.6 | ) | $ | (22.1 | ) | nm | $ | (12.4 | ) | $ | (2.7 | ) | nm | |||||||||||

| Adjusted EBITDA | $ | 61.1 | $ | 51.6 | 18.4% | $ | 111.2 | $ | 118.0 | (5.8%) | |||||||||||||||

| Adjusted EBITDA Margin | 10.2 | % | 8.7 | % | 150 bps | 9.9 | % | 10.3 | % | -40 bps | |||||||||||||||

| Adjusted Net Income | $ | 15.6 | $ | 7.6 | 106.3% | $ | 26.0 | $ | 21.0 | 24.1% | |||||||||||||||

| Earnings per Share, GAAP | $ | (0.04 | ) | $ | (0.29 | ) | nm | $ | (0.12 | ) | $ | (0.04 | ) | nm | |||||||||||

| Earnings per Share, Adjusted | $ | 0.15 | $ | 0.10 | 54.6% | $ | 0.25 | $ | 0.27 | (6.9%) | |||||||||||||||

| Weighted average number of common shares outstanding | 102.8 | 77.0 | 33.4% | 102.6 | 77.1 | 33.2% | |||||||||||||||||||

For the second quarter fiscal 2019, total revenue increased 1.1% to $596.6 million due to an increase in Maintenance Services Segment revenue, partially offset by a decline in Development Services Segment revenue. Total Adjusted EBITDA increased 18.4% driven by an increase in the Maintenance Services Segment coupled with a reduction of corporate expenses, partially offset by a decrease in the Development Services Segment Adjusted EBITDA, as discussed further below.

For the six months ended March 31, 2019, total revenue decreased 1.6% to $1,122.7 million due to declines in both the Maintenance Services Segment and Development Services Segment revenues. Total Adjusted EBITDA was $111.2 million, down 5.8% versus the prior year, driven by lower revenues, partially offset by a reduction of corporate expenses.

Fiscal 2019 Results – Segments

| Maintenance Services - Operating Highlights | |||||||||||||||||||||||||

| Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||||||||||||

| ($ in millions) | 2019 | 2018 | Change | 2019 | 2018 | Change | |||||||||||||||||||

| Landscape Maintenance | $ | 281.8 | $ | 270.0 | 4.4% | $ | 626.1 | $ | 623.1 | 0.5% | |||||||||||||||

| Snow Removal | $ | 191.5 | $ | 190.1 | 0.8% | $ | 239.7 | $ | 243.7 | (1.6%) | |||||||||||||||

| Total Revenue | $ | 473.3 | $ | 460.1 | 2.9% | $ | 865.8 | $ | 866.8 | (0.1%) | |||||||||||||||

| Adjusted EBITDA | $ | 65.0 | $ | 58.3 | 11.5% | $ | 113.7 | $ | 118.9 | (4.4%) | |||||||||||||||

| Adjusted EBITDA Margin | 13.7 | % | 12.7 | % | 100 bps | 13.1 | % | 13.7 | % | -60 bps | |||||||||||||||

| Capital Expenditures | $ | 18.9 | $ | 12.8 | 47.8% | $ | 30.0 | $ | 19.5 | 54.2% | |||||||||||||||

For the second quarter fiscal 2019, revenue in the Maintenance Services Segment increased 2.9% to $473.3 million. Landscape Maintenance Services revenue increased 4.4%. Acquisitions added 8.4% but were partially offset by a 4.0% negative revenue contribution from commercial landscaping, including lower revenue due to Managed Exits as the Company strategically reduced a number of less profitable accounts established in previous years. Including revenue contribution from acquisitions, snow removal services revenue increased 0.8%.

Adjusted EBITDA for the Maintenance Services Segment in the quarter increased 11.5% to $65.0 million, with the Adjusted EBITDA margin increasing 100 basis points versus the prior year quarter. The increase in segment profitability was mainly a result of the increase in revenue described above, coupled with a continued focus on efficiency initiatives to reduce overhead, personnel and related costs across the Company’s core functions.

For the six months ended March 31, 2019, revenue in the Maintenance Services Segment remained relatively flat at $865.8 million. Landscape Maintenance Services revenue increased 0.5%. Acquisitions added 7.2% but were mostly offset by a 6.7% negative revenue contribution from commercial landscaping, including a difficult comparison with the revenue related to Hurricane Irma and Maria clean-up, the final impact from the prior-year turnover of national accounts, and lower revenue due to Managed Exits as the Company strategically reduced the number of less profitable accounts established in previous years. Snow removal services revenue decreased 1.6% due to lower year-over-year snowfall in key geographies, especially during the first quarter of fiscal 2019.

Adjusted EBITDA for the Maintenance Services Segment for the six months ended March 31, 2019 decreased 4.4% to $113.7 million, with the Adjusted EBITDA margin decreasing 60 basis points versus the prior year period. The decline in segment profitability was mainly a result of higher-margin hurricane clean-up activity in the first quarter of fiscal 2018 and a decline in the contribution from snow removal services due to timing and below average snowfall during the first quarter compared to the prior year quarter.

| Development Services - Operating Highlights | |||||||||||||||||||||||||

| Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||||||||||||

| ($ in millions) | 2019 | 2018 | Change | 2019 | 2018 | Change | |||||||||||||||||||

| Revenue | $ | 124.0 | $ | 131.0 | (5.4%) | $ | 258.4 | $ | 276.2 | (6.5%) | |||||||||||||||

| Adjusted EBITDA | $ | 11.0 | $ | 12.9 | (14.3%) | $ | 28.1 | $ | 33.3 | (15.8%) | |||||||||||||||

| Adjusted EBITDA Margin | 8.9 | % | 9.8 | % | -90 bps | 10.9 | % | 12.1 | % | -120 bps | |||||||||||||||

| Capital Expenditures | $ | 3.5 | $ | 0.9 | 302.1% | $ | 6.7 | $ | 1.8 | 275.6% | |||||||||||||||

Revenues for the Development Services Segment decreased 5.4% to $124.0 million for the second quarter fiscal 2019. Project revenue derived from acquisitions coupled with commencement of work on new projects contributed to offset a decrease driven by the timing of work performed on certain large projects during the prior year period.

Adjusted EBITDA for the Development Services Segment decreased 14.3% to $11.0 million in the quarter, negatively affected by the decrease in net revenue described above, as well as an increase in selling, general and administrative expense, which was the result of a cash collection in the second quarter of fiscal 2018 on a previously reserved receivable.

Revenues for the Development Services Segment decreased 6.5% to $258.4 million for the six months ended March 31, 2019. Project revenue derived from acquisitions coupled with commencement of work on new projects partially offset a challenging comparison with revenues generated from work performed on certain large projects in the prior year period.

Adjusted EBITDA for the Development Services Segment decreased 15.8% to $28.1 million during the six months ended March 31, 2019, negatively affected by the decrease in net revenue described above, as well as an increase in selling, general and administrative expense as described above.

| Total BrightView Cash Flow Metrics | |||||||||||

| Six Months Ended March 31, | |||||||||||

| ($ in millions) | 2019 | 2018 | Change | ||||||||

| Cash Provided by Operating Activities | $ | 64.7 | $ | 79.2 | (18.3%) | ||||||

| Adjusted Free Cash Flow | $ | 25.1 | $ | 58.2 | (56.9%) | ||||||

| Capital Expenditures | $ | 42.6 | $ | 44.1 | (3.4%) | ||||||

Net cash provided by operating activities for the six months ended March 31, 2019 was $64.7 million, compared to $79.2 million for the prior year. The decrease was primarily due to an increase in accounts receivable due to timing of collections, partially offset by an increase in deferred revenue. Adjusted Free Cash Flow for the six months ended March 31, 2019 was $25.1 million, a decrease in cash generation of $33.1 million versus the prior year. The decrease is reflective of the decrease in net cash provided by operating activities as well as an increase in capital expenditures excluding the fiscal 2018 purchase of legacy ValleyCrest facilities of $21.6 million.

For the six months ended March 31, 2019, capital expenditures were $42.6 million, compared with $44.1 million last year. The prior year period included the aforementioned purchase of legacy ValleyCrest facilities. The Company also generated proceeds from the sale of property and equipment of $3.0 million and $1.5 million in the first half of fiscal 2019 and 2018, respectively. Net of the legacy asset purchase and the proceeds from the sale of property and equipment in each year, capital expenditures represented 3.5% and 1.8% of revenue in the first half of fiscal 2019 and 2018, respectively.

| Total BrightView Balance Sheet Metrics | |||||||||||

| ($ in millions) | March 31, 2019 | December 31, 2018 | September 30, 2018 | ||||||||

| Total Financial Debt1 | $ | 1,185.3 | $ | 1,179.1 | $ | 1,184.4 | |||||

| Total Cash & Equivalents | $ | 11.2 | $ | 17.1 | $ | 35.2 | |||||

| Total Net Financial Debt2 to Adjusted EBITDA ratio | 4.0x | 4.1x | 3.8x | ||||||||

| 1Total Financial Debt includes total long-term debt, net of original issue discount, and capital lease obligations | |||||||||||

| 2Total Net Financial Debt equals Total Financial Debt minus Total Cash & Equivalents | |||||||||||

As of March 31, 2019, the Company’s Total Net Financial Debt was $1.174 billion, an increase of $24.9 million compared to $1.149 billion at the fiscal year end. The Company’s Total Net Financial Debt to Adjusted EBITDA ratio was 4.0x as of March 31, 2019, compared with 4.1x as of December 31, 2018.

Recent Developments

New Independent Board Members

On April 15, BrightView announced the appointment of Jane Okun Bomba, President of Saddle Ridge Consulting, and Mara Swan, Executive Vice President of Global Strategy and Talent at ManpowerGroup, as independent members of its Board of Directors. The appointments of Ms. Okun Bomba and Ms. Swan expands the size of the board to eight members, four of whom have been determined to be independent.

New Corporate Headquarters in Blue Bell, Pa.

During the week of April 29, 2019, the Company relocated its Corporate Headquarters to a new facility in Blue Bell, Pennsylvania. The new headquarters consolidates various corporate work groups from around the country. It is also the new site of the BrightView National Training Center, which will offer an expanded curriculum and train a larger number of its field personnel across a number of topics designed to drive incremental sales, improve customer retention and develop the Company’s future leaders, among other initiatives.

Conference Call Information

A conference call to discuss the second quarter fiscal 2019 financial results is scheduled for May 8, 2019, at 10 a.m. Eastern Daylight Time. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 7885175. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where presentation materials will be posted prior to the call.

A telephone replay will be available shortly after the broadcast through May 15, 2019, by dialing 800-585-8367 from the U.S., and entering conference passcode 7885175. A replay of the audio webcast also will be archived on the Company’s investor website.

About BrightView:

BrightView (NYSE: BV), the nation’s largest commercial landscaper, proudly designs, creates, and maintains the best landscapes on Earth and provides the most efficient and comprehensive snow and ice removal services. With a dependable service commitment, BrightView brings brilliant landscapes to life at premier properties across the United States, including business parks and corporate offices, homeowners' associations, healthcare facilities, educational institutions, retail centers, resorts and theme parks, municipalities, golf courses, and sports venues. BrightView also serves as the Official Field Consultant to Major League Baseball. Through industry-leading best practices and sustainable solutions, BrightView is invested in taking care of our team members, engaging our clients, inspiring our communities, and preserving our planet. Visit www.BrightView.com and connect with us on X (formerly Twitter), Facebook, and LinkedIn.

For more information and/or permission to use BrightView images and assets, please send all media inquiries to communications@brightview.com