BrightView Reports Second Quarter Fiscal 2020 Results

BrightView Holdings, Inc. (NYSE:BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the second quarter ended March 31, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200507005220/en/

(Graphic: Business Wire)

Second Quarter Fiscal 2020 Highlights

- Maintenance revenue of $416.2 million; a 12.1% decline compared to prior year of $473.3 million;

- Snow revenue of $102.5 million; a 46.5% decline compared to prior year of $191.5 million.

- Decline driven by meaningfully lower snowfall as compared to historical averages.

- Land revenue of $313.7 million; 11.3% growth compared to prior year of $281.8 million.

- Maintenance land organic growth of 1.9%.

- Snow revenue of $102.5 million; a 46.5% decline compared to prior year of $191.5 million.

- Development revenue of $143.6 million, a 15.8% increase compared to prior year of $124.0 million;

- M&A strategy continues to be a reliable and sustainable source of revenue growth;

- Acquired three commercial landscaping companies in critical and growing markets;

- Net Loss of $20.5 million, or $(0.20) per share, and a net loss margin of 3.7%, compared to Net Loss of $3.6 million, or $(0.04) per share, and a net loss margin of 0.6%, in the prior year;

- Adjusted EBITDA of $38.9 million and Adjusted EBITDA margin of 7.0%, compared to Adjusted EBITDA of $61.1 million and Adjusted EBITDA margin of 10.2% in the prior year, with the negative variance largely driven by the decremental margins due to the 46.5% lower snow revenue which would normally better leverage our fixed cost base during the snow season;

- Cash flows from operating activities of $78.4 million, an increase of 34.5% compared to $58.3 million in the prior year;

- Free Cash Flow of $59.4 million, an increase of 73.7% compared to prior year of $34.2 million.

Six Months Fiscal 2020 Highlights

- Total Revenues for the six months were $1,129.8 million, a 0.6% increase compared to $1,122.7 million in the prior year;

- Maintenance revenue of $835.1 million; a 3.5% decline compared to prior year of $865.8 million;

- Snow revenue of $158.1 million; a 34.0% decline compared to prior year of $239.7 million.

- Decline driven by meaningfully lower snowfall as compared to historical averages.

- Land revenue of $677.0 million; 8.1% growth compared to prior year of $626.1 million.

- Maintenance land organic growth of 0.7% excluding the impact in the first fiscal quarter from the wind down of our strategic managed exit initiative.

- Snow revenue of $158.1 million; a 34.0% decline compared to prior year of $239.7 million.

- Development revenue of $296.4 million, a 14.7% increase compared to prior year of $258.4 million;

- Net Loss of $33.1 million, or ($0.32) per share, and a net loss margin of 2.9%, compared to Net Loss of $12.4 million, or ($0.12) per share, and a net loss margin of 1.1%, in the prior year;

- Adjusted EBITDA of $90.5 million and Adjusted EBITDA margin of 8.0%, compared to Adjusted EBITDA of $111.2 million and Adjusted EBITDA margin of 9.9% in the prior year, with the negative variance largely driven by the decremental margins due to the lower snow revenue;

- Cash flows from operating activities of $85.7 million, an increase of 32.5% compared to $64.7 million in the prior year;

- Free Cash Flow of $53.3 million, an increase of 112.4% compared to prior year of $25.1 million.

“We are very pleased with our Landscape maintenance organic revenue growth of 1.9% in the quarter, which was the strongest since our 2018 IPO. Free Cash Flow remains robust and our Development Segment delivered its third straight quarter of double-digit revenue growth,” said Andrew Masterman, BrightView President and Chief Executive Officer. “Historically low snowfall in many of our key regions had an adverse impact on both revenue and Adjusted EBITDA, but we are encouraged by the growth trend on snow contracts. Further, our acquisition strategy continued to be a reliable and sustainable source of revenue growth. As an essential service as defined by the Department of Homeland Security, all branches are operational at this time, with only isolated limitations as to the scope of services we can provide, specifically in the city of Boston, New York City and the San Francisco Bay Area. Keeping our employees, their families and our customers safe is our number one priority. BrightView is well positioned to overcome potential headwinds due to the COVID-19 outbreak and emerge from this crisis a stronger company.”

Fiscal 2020 Results – Total BrightView

|

Total BrightView - Operating Highlights |

|||||||||||||||||||||

|

|

|

Three Months Ended |

|

|

Six Months Ended |

||||||||||||||||

|

($ in millions, except per share figures) |

|

2020 |

|

|

2019 |

|

|

Change |

|

|

2020 |

|

|

2019 |

|

|

Change |

||||

|

Revenue |

|

$ |

559.1 |

|

|

$ |

596.6 |

|

|

(6.3%) |

|

|

$ |

1,129.8 |

|

|

$ |

1,122.7 |

|

|

0.6% |

|

Net Loss |

|

$ |

(20.5 |

) |

|

$ |

(3.6 |

) |

|

469.4% |

|

|

$ |

(33.1 |

) |

|

$ |

(12.4 |

) |

|

166.9% |

|

Net Loss Margin |

|

|

(3.7 |

%) |

|

|

(0.6 |

%) |

|

516.7% |

|

|

|

(2.9 |

%) |

|

|

(1.1 |

%) |

|

163.6% |

|

Adjusted EBITDA |

|

$ |

38.9 |

|

|

$ |

61.1 |

|

|

(36.3%) |

|

|

$ |

90.5 |

|

|

$ |

111.2 |

|

|

(18.6%) |

|

Adjusted EBITDA Margin |

|

|

7.0 |

% |

|

|

10.2 |

% |

|

(320) bps |

|

|

|

8.0 |

% |

|

|

9.9 |

% |

|

(190) bps |

|

Adjusted Net Income |

|

$ |

1.9 |

|

|

$ |

15.6 |

|

|

(87.8%) |

|

|

$ |

12.5 |

|

|

$ |

26.0 |

|

|

(51.9%) |

|

Earnings per Share, GAAP |

|

$ |

(0.20 |

) |

|

$ |

(0.04 |

) |

|

(400.0%) |

|

|

$ |

(0.32 |

) |

|

$ |

(0.12 |

) |

|

(166.7%) |

|

Earnings per Share, Adjusted |

|

$ |

0.02 |

|

|

$ |

0.15 |

|

|

(86.7%) |

|

|

$ |

0.12 |

|

|

$ |

0.25 |

|

|

(52.0%) |

|

Weighted average number of common shares outstanding |

|

|

103.7 |

|

|

|

102.8 |

|

|

0.9% |

|

|

|

103.5 |

|

|

|

102.6 |

|

|

0.9% |

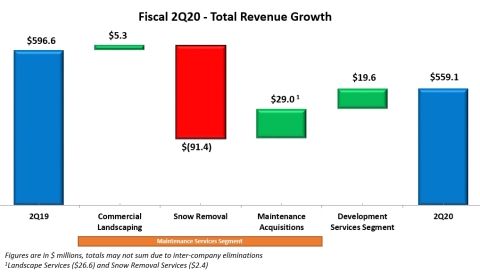

For the second quarter of fiscal 2020, total revenue decreased 6.3% to $559.1 million due to decreases in the Maintenance Services Segment driven by meaningfully lower snowfall as compared to historical averages, partially offset by increases in Development Services Segment revenues. Net Loss was $20.5 million compared to $3.6 million in the 2019 period, attributable to lower Income from operations and a decrease in Other income, partially offset by a decrease in Interest expense and an increase in the Income tax benefit. Total Adjusted EBITDA decreased 36.3% due to a decrease in Maintenance Services Segment Adjusted EBITDA driven by the decremental margins as a result of the lower snow revenue, partially offset by an increase in Development Services Segment Adjusted EBITDA, as discussed further below.

For the six months ended March 31, 2020, total revenue increased 0.6% to $1,129.8 million due to increases in Development Services Segment, partially offset by a decrease in Maintenance Services Segment revenues driven by meaningfully lower snowfall as compared to historical averages. Total Adjusted EBITDA was $90.5 million, down 18.6% versus the prior year, due to a decrease in Maintenance Services Segment Adjusted EBITDA driven by the decremental margins as a result of the lower snow revenue, partially offset by an increase in Development Services Segment Adjusted EBITDA, as discussed further below.

Fiscal 2020 Results – Segments

|

Maintenance Services - Operating Highlights |

|||||||||||||||||||||

|

|

|

Three Months Ended |

|

|

Six Months Ended |

||||||||||||||||

|

($ in millions) |

|

2020 |

|

|

2019 |

|

|

Change |

|

|

2020 |

|

|

2019 |

|

|

Change |

||||

|

Landscape Maintenance |

|

$ |

313.7 |

|

|

$ |

281.8 |

|

|

11.3% |

|

|

$ |

677.0 |

|

|

$ |

626.1 |

|

|

8.1% |

|

Snow Removal |

|

$ |

102.5 |

|

|

$ |

191.5 |

|

|

(46.5%) |

|

|

$ |

158.1 |

|

|

$ |

239.7 |

|

|

(34.0%) |

|

Total Revenue |

|

$ |

416.2 |

|

|

$ |

473.3 |

|

|

(12.1%) |

|

|

$ |

835.1 |

|

|

$ |

865.8 |

|

|

(3.5%) |

|

Adjusted EBITDA |

|

$ |

41.2 |

|

|

$ |

65.0 |

|

|

(36.6%) |

|

|

$ |

88.9 |

|

|

$ |

113.7 |

|

|

(21.8%) |

|

Adjusted EBITDA Margin |

|

|

9.9 |

% |

|

|

13.7 |

% |

|

(380) bps |

|

|

|

10.6 |

% |

|

|

13.1 |

% |

|

(250) bps |

|

Capital Expenditures |

|

$ |

14.3 |

|

|

$ |

18.9 |

|

|

(24.3%) |

|

|

$ |

26.1 |

|

|

$ |

30.0 |

|

|

(13.0%) |

For the second quarter fiscal 2020, revenue in the Maintenance Services Segment decreased 12.1% to $416.2 million. Revenues from snow removal services were $102.5 million, a decrease of $89.0 million over the 2019 period and revenue from landscape maintenance services were $313.7 million, an increase of $31.9 million over the 2019 period. The decrease in snow removal services was primarily attributable to a decreased frequency of snowfall events, the lower volume of snowfall per event and the lower relative snowfall in the three months ended March 31, 2020 as compared to the 2019 period (for our current branch structure, snowfall for the three months ended March 31, 2020 and 2019 was 43.3% and 86.2%, respectively, of the historical 10-year average for that three-month period). The increase in landscape maintenance services was driven by a $26.6 million revenue contribution from acquired businesses as well as $5.3 million or 1.9% growth in underlying commercial landscaping.

Adjusted EBITDA for the Maintenance Services Segment in the quarter decreased 36.6% to $41.2 million, with the Adjusted EBITDA Margin decreasing 380 basis points versus the prior year. The decrease in Adjusted EBITDA Margin was principally due to the decrease in snow removal revenues described above as well as an increase in selling, general, and administrative expenses to drive new business growth and increase customer retention.

For the six months ended March 31, 2020, revenue in the Maintenance Services Segment decreased 3.5% to $835.1 million. Revenues from snow removal services were $158.1 million, a decrease of $81.6 million over the 2019 period and revenues from landscape maintenance services were $677.0 million, an increase of $50.9 million over the 2019 period. The decrease in snow removal services is primarily attributable to a decreased frequency of snowfall events, the lower volume of snowfall per event and the lower relative snowfall in the six months ended March 31, 2020 (for our current branch structure, snowfall for the six months ended March 31, 2020 and 2019 was 57.9% and 85.6%, respectively, of the historical 10-year average for that six-month period). The increase in landscape services revenues was driven by a $48.2 million revenue contribution from acquired businesses as well as $4.4 million or 0.7% growth in underlying commercial landscaping excluding the impact in the first fiscal quarter from the wind down of our strategic managed exit initiative.

Adjusted EBITDA for the Maintenance Services Segment for the six months ended March 31, 2020 decreased 21.8% to $88.9 million, with the Adjusted EBITDA margin decreasing 250 basis points versus the prior year. The decrease in Segment Adjusted EBITDA was due to the decrease in snow removal revenues described above as well as an increase in selling, general, and administrative expenses to drive new business growth and increase customer retention.

|

Development Services - Operating Highlights |

|||||||||||||||||||||

|

|

|

Three Months Ended |

|

|

Six Months Ended |

||||||||||||||||

|

($ in millions) |

|

2020 |

|

|

2019 |

|

|

Change |

|

|

2020 |

|

|

2019 |

|

|

Change |

||||

|

Revenue |

|

$ |

143.6 |

|

|

$ |

124.0 |

|

|

15.8% |

|

|

$ |

296.4 |

|

|

$ |

258.4 |

|

|

14.7% |

|

Adjusted EBITDA |

|

$ |

13.7 |

|

|

$ |

11.0 |

|

|

24.5% |

|

|

$ |

32.8 |

|

|

$ |

28.1 |

|

|

16.7% |

|

Adjusted EBITDA Margin |

|

|

9.5 |

% |

|

|

8.9 |

% |

|

60 bps |

|

|

|

11.1 |

% |

|

|

10.9 |

% |

|

20 bps |

|

Capital Expenditures |

|

$ |

5.9 |

|

|

$ |

3.5 |

|

|

68.6% |

|

|

$ |

7.9 |

|

|

$ |

6.7 |

|

|

17.9% |

For the second quarter fiscal 2020, revenue in the Development Services Segment increased 15.8% to $143.6 million. The increase in Development Services revenues was driven by higher project volumes and an increase in the project completion percentage compared to the 2019 period.

Adjusted EBITDA for the Development Services Segment increased 24.5% to $13.7 million in the quarter. The increase in Segment Adjusted EBITDA was due to the increase in net service revenues described above combined with productivity improvements across the segment. Segment Adjusted EBITDA Margin increased 60 basis points, to 9.5%, in the three months ended March 31, 2020, from 8.9% in the 2019 period.

Revenues for the Development Services Segment increased 14.7% to $296.4 million for the six months ended March 31, 2020. The increase in Development Services revenues was driven by higher project volumes and an increase in the project completion percentage compared to the prior fiscal period.

Adjusted EBITDA for the Development Services Segment increased 16.7% to $32.8 million during the six months ended March 31, 2020. The increase in Segment Adjusted EBITDA was due to the increase in net service revenues described above as well as increased productivity across the segment. Segment Adjusted EBITDA Margin increased 20 basis points, to 11.1%, in the six months ended March 31, 2020, from 10.9% in the 2019 period.

|

Total BrightView Cash Flow Metrics |

|

||||||||||

|

|

|

Six Months Ended |

|

||||||||

|

($ in millions) |

|

2020 |

|

|

2019 |

|

|

Change |

|

||

|

Cash Provided by Operating Activities |

|

$ |

85.7 |

|

|

$ |

64.7 |

|

|

32.5% |

|

|

Free Cash Flow |

|

$ |

53.3 |

|

|

$ |

25.1 |

|

|

112.4% |

|

|

Capital Expenditures |

|

$ |

35.1 |

|

|

$ |

42.6 |

|

|

(17.6%) |

|

Net cash provided by operating activities for the six months ended March 31, 2020 was $85.7 million, compared to $64.7 million for the prior year. This increase was primarily due to an increase in cash provided by accounts receivable and an increase in cash provided by unbilled and deferred revenue offset by a decrease in cash provided by other operating assets and a decrease in cash provided by accounts payable and other operating liabilities.

Free Cash Flow for the six months ended March 31, 2020 was $53.3 million, an increase of $28.2 million versus the prior year. The increase in Free Cash Flow was principally due to the increase in cash flows from operating activities of $21.0 million described above, as well as a decrease in capital expenditures of $7.5 million as further described below.

For the six months ended March 31, 2020, capital expenditures were $35.1 million, compared with $42.6 million in the prior year. The Company also generated proceeds from the sale of property and equipment of $2.7 million and $3.0 million in the first half of fiscal 2020 and 2019, respectively. Net of the proceeds from the sale of property and equipment in the six months, net capital expenditures represented 3.3% and 4.1% of revenue in the first half of fiscal 2020 and 2019, respectively.

|

Total BrightView Balance Sheet Metrics |

||||||||

|

($ in millions) |

March 31, |

March 31, |

September 30, |

|||||

|

Total Financial Debt1 |

$ |

1,254.4 |

$ |

1,185.3 |

$ |

1,170.2 |

||

|

Total Cash & Equivalents |

$ |

88.0 |

$ |

11.2 |

$ |

39.1 |

||

|

Total Net Financial Debt2 to Adjusted EBITDA ratio |

4.1x |

4.0x |

3.7x |

|||||

|

1Total Financial Debt includes total long-term debt, net of original issue discount, and finance/capital lease obligations |

||||||||

|

2Total Net Financial Debt equals Total Financial Debt minus Total Cash & Equivalents |

||||||||

As of March 31, 2020, the Company’s Total Net Financial Debt was $1,166.4 million, a decrease of $7.7 million compared to $1,174.1 million as of March 31, 2019. The Company’s Total Net Financial Debt to Adjusted EBITDA ratio was 4.1x as of March 31, 2020, compared with 4.0x as of March 31, 2019.

Second Quarter Acquisitions

During the second quarter, BrightView acquired Signature Coast Holdings, LLC, Summit Landscape Group, LLC and 4 Seasons Landscape Group, LLC. These acquisitions are consistent with BrightView’s long-term M&A strategy and further strengthens its presence in critical and growing markets:

- Signature Coast’s operations span nine strategic locations in both California (Concord, Davis, Marin, Napa, Rocklin, Sacramento and Santa Rosa) and Nevada (Carson City and Reno). Signature provides landscape maintenance, irrigation, enhancement, and arbor care.

- Established in 2011, Summit serves the Charlotte, Charleston and Hilton Head markets in the Carolinas, as well as clients in Nashville, Tennessee. The Summit team offers a full suite of landscaping services including turf management, agronomics, tree and plant care, landscape design and installation, storm water control and inspection, and soil stabilization.

- 4 Seasons provides services across the Atlanta metropolitan market in landscape maintenance, hardscapes, irrigation, enhancement, arbor care and other facility support services to the commercial, multi-family, hospitality, municipal and HOA market segments.

COVID-19 Update

- Throughout virtually the entire country, landscape maintenance is recognized as an essential service as defined by the Department of Homeland Security.

- All branches operational; isolated limitations on the scope of services we can provide.

- Executing downturn playbook and implementing prudent actions to preserve cash.

- Temporarily deferring discretionary merit increases for all employees and implemented a hiring freeze.

- Limiting all discretionary spending and capital expenditures.

- Specific Health and Safety actions include:

- Proactively communicating critical information from CDC to all employees.

- Implemented branch based social distancing and hygiene and sanitization procedures.

- Continuing to prohibit non-essential travel and mandated work from home policies as applicable.

- Adhering to all state and local mandates and guidelines.

- Tracking potential cases and exposure, assigning case workers, and launched paid sick leave.

Conference Call Information

A conference call to discuss the second quarter fiscal 2020 financial results is scheduled for May 7, 2020, at 10 a.m. EDT. The dial-in for the conference call is (833) 968-2326 and the international dial-in is (778) 560-2844. The conference ID is 7999761. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where the presentation materials will be posted prior to the call.

A replay of the call will be available from 1 p.m. EDT on May 7, 2020 to 11:59 p.m. EDT on May 14, 2020. To access the recording, dial (800) 585-8367 or (416) 621-4642. The conference ID is 7999761.

About BrightView:

BrightView (NYSE: BV), the nation’s largest commercial landscaper, proudly designs, creates, and maintains the best landscapes on Earth and provides the most efficient and comprehensive snow and ice removal services. With a dependable service commitment, BrightView brings brilliant landscapes to life at premier properties across the United States, including business parks and corporate offices, homeowners' associations, healthcare facilities, educational institutions, retail centers, resorts and theme parks, municipalities, golf courses, and sports venues. BrightView also serves as the Official Field Consultant to Major League Baseball. Through industry-leading best practices and sustainable solutions, BrightView is invested in taking care of our team members, engaging our clients, inspiring our communities, and preserving our planet. Visit www.BrightView.com and connect with us on X (formerly Twitter), Facebook, and LinkedIn.

For more information and/or permission to use BrightView images and assets, please send all media inquiries to communications@brightview.com