BrightView Reports Fourth Quarter and Full Year Fiscal 2019 Results

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the fourth quarter and audited results for the full fiscal year ended September 30, 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191121005210/en/

(Graphic: Business Wire)

Fourth Quarter Fiscal 2019 Highlights

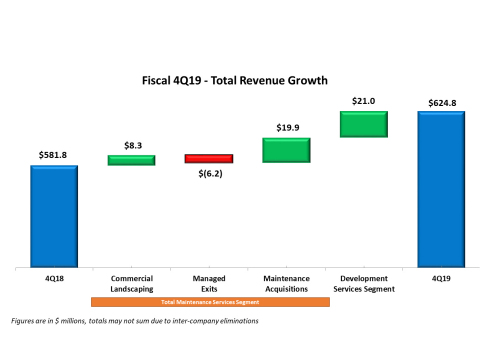

- Total Revenues for the quarter were $624.8 million, a 7.4% increase versus the prior year, with 5.1% higher Maintenance Services Segment revenues and 14.0% higher Development Services Segment revenues;

- Maintenance Services Segment revenue of $455.4 million benefitted from growth in underlying commercial landscaping revenue and acquisitions;

- Development Services Segment revenue of $170.7 million was the highest quarterly result in the segment’s history;

- Net Income of $25.1 million, or $0.24 per share, and a net income margin of 4.0%, compared to Net Loss of ($10.9 million), or ($0.11) per share, and a net loss margin of (1.9%), in the prior year;

- Adjusted EBITDA of $91.9 million, or 9.1% growth over the prior year, with a margin of 14.7%;

- Adjusted Net Income of $45.0 million, or $0.44 per share, up from $35.8 million, or $0.35 per share, in the prior year.

Full Year Fiscal 2019 Highlights

- Total Revenues for the fiscal year were $2,404.6 million, a 2.2% increase versus the prior year, with 2.2% higher Maintenance Services Segment revenues and 2.1% higher Development Services Segment revenues;

- Net Income of $44.4 million, or $0.43 per share, and a net income margin of 1.8%, compared to Net Loss of ($15.1 million), or ($0.18) per share, and a net loss margin of (0.6%), in the prior year;

- Adjusted EBITDA of $305.1 million, or 1.7% above the prior year, with a margin of 12.7%;

- Adjusted Net Income of $118.0 million, or $1.15 per share, up from $90.0 million, or $1.08 per share, in the prior year;

- Net Cash Provided by Operating Activities was $169.7 million and Free Cash Flow was $86.6 million;

- Completed six acquisitions with an estimated $83.1 million of aggregate annualized revenue.

“Our strategic initiatives, designed to establish a base for sustainable, long-term growth, began delivering results in fiscal 2019. Underlying commercial landscaping revenue grew in the fourth quarter and full year, despite facing significant weather-related challenges across many key markets. And we continued executing our Strong-on-Strong M&A strategy while reducing our Net Debt. Nonetheless, we fell short of some of our full year targets and are working hard to deliver on the long-term potential of our business, beginning with fiscal 2020,” said Andrew Masterman, BrightView President and Chief Executive Officer. “We will build on our 2019 successes, including (a) the sequential revenue improvement in underlying commercial landscaping, (b) the excellent results that our Development Segment generated in the second half of 2019 with strong bookings going into 2020, and (c) the reliable revenue growth that our M&A pipeline, once again, delivered. We will also maintain our targeted plans to invest in technology to support our sales and account manager teams, enhancing our customer relationships and driving both revenue growth and cash generation, which we believe are the cornerstones of stockholder value.”

Unless indicated otherwise, the information in this release has been adjusted to give effect to a 2.33839-for-one reverse stock split of the Company’s common stock effected on June 8, 2018. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Free Cash Flow and Adjusted Earnings per Share are non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” sections for more information.

Fiscal 2019 Results – Total BrightView

|

Total BrightView - Operating Highlights |

|||||||||||||||||

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

|||||||||||||

|

($ in millions, except per share figures) |

|

2019 |

|

2018 |

|

Change |

|

2019 |

|

2018 |

|

Change |

|||||

|

Revenue |

|

$ |

624.8 |

|

$ |

581.8 |

|

7.4% |

|

$ |

2,404.6 |

|

$ |

2,353.6 |

|

2.2% |

|

|

Net income (loss) |

|

$ |

25.1 |

|

$ |

(10.9 |

) |

nm |

|

$ |

44.4 |

|

$ |

(15.1 |

) |

nm |

|

|

Adjusted EBITDA |

|

$ |

91.9 |

|

$ |

84.2 |

|

9.1% |

|

$ |

305.1 |

|

$ |

300.1 |

|

1.7% |

|

|

Adjusted EBITDA Margin |

|

|

14.7 |

% |

|

14.5 |

% |

20 bps |

|

|

12.7 |

% |

|

12.8 |

% |

-10 bps |

|

|

Adjusted Net Income |

|

$ |

45.0 |

|

$ |

35.8 |

|

25.7% |

|

$ |

118.0 |

|

$ |

90.0 |

|

31.1% |

|

|

Earnings per Share, GAAP |

|

$ |

0.24 |

|

$ |

(0.11 |

) |

nm |

|

$ |

0.43 |

|

$ |

(0.18 |

) |

nm |

|

|

Earnings per Share, Adjusted |

|

$ |

0.44 |

|

$ |

0.35 |

|

25.7% |

|

$ |

1.15 |

|

$ |

1.08 |

|

6.5% |

|

|

Weighted average number of common shares outstanding |

|

|

102.9 |

|

|

102.1 |

|

0.8% |

|

|

102.8 |

|

|

83.4 |

|

23.3% |

|

For the fourth quarter of fiscal 2019, total revenue increased 7.4% to $624.8 million due to increases in both Maintenance Services Segment and Development Services Segment revenues. Total Adjusted EBITDA increased 9.1% driven by an increase in the Development Services Segment Adjusted EBITDA as well as lower corporate expenses and partially offset by a decrease in Maintenance Services Segment Adjusted EBITDA, as discussed further below.

For the fiscal year ended September 30, 2019, total revenue increased 2.2% to $2,404.6 million due to an increase in both Maintenance Services Segment and Development Services Segment revenues. Total Adjusted EBITDA was $305.1 million, up 1.7% versus the prior year, driven by an increase in Development Services Segment Adjusted EBITDA as well as lower corporate expenses and partially offset by a decrease in Maintenance Services Segment Adjusted EBITDA.

Fiscal 2019 Results – Segments

|

Maintenance Services - Operating Highlights |

|||||||||||||||||||

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

|||||||||||||||

|

($ in millions) |

|

2019 |

|

2018 |

|

Change |

|

2019 |

|

2018 |

|

Change |

|||||||

|

Landscape Maintenance |

|

$ |

455.7 |

|

$ |

433.7 |

|

5.1% |

|

$ |

1,568.3 |

|

$ |

1,522.5 |

|

3.0% |

|||

|

Snow Removal |

|

$ |

(0.3 |

) |

$ |

(0.3 |

) |

0.0% |

|

$ |

245.1 |

|

$ |

252.3 |

|

(2.9%) |

|||

|

Total Revenue |

|

$ |

455.4 |

|

$ |

433.4 |

|

5.1% |

|

$ |

1,813.4 |

|

$ |

1,774.8 |

|

2.2% |

|||

|

Adjusted EBITDA |

|

$ |

77.2 |

|

$ |

79.6 |

|

(3.0%) |

|

$ |

282.0 |

|

$ |

289.8 |

|

(2.7%) |

|||

|

Adjusted EBITDA Margin |

|

|

17.0 |

% |

|

18.4 |

% |

-140 bps |

|

|

15.6 |

% |

|

16.3 |

% |

-70 bps |

|||

|

Capital Expenditures |

|

$ |

10.9 |

|

$ |

11.8 |

|

(7.6%) |

|

$ |

65.4 |

|

$ |

45.5 |

|

43.7% |

|||

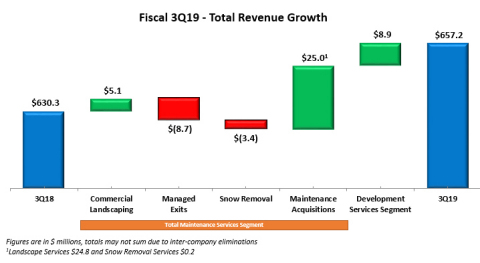

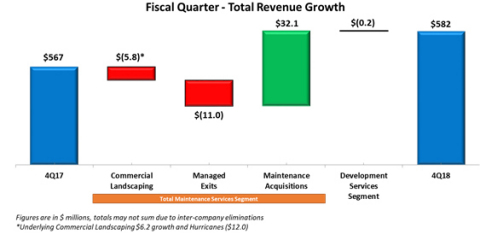

For the fourth quarter fiscal 2019, revenue in the Maintenance Services Segment increased 5.1% to $455.4 million. Landscape Maintenance revenue also increased 5.1%. Landscape Maintenance acquisitions added 4.6% and commercial landscaping added 0.5% which included lower revenue due to Managed Exits as the Company strategically reduced a number of less profitable accounts established in previous years. Excluding Managed Exits, the Company’s underlying commercial landscaping revenue grew 1.9% versus the prior-year quarter driven by growth in contract maintenance, ancillary services and national accounts.

Adjusted EBITDA for the Maintenance Services Segment in the quarter decreased 3.0% to $77.2 million, with the Adjusted EBITDA Margin decreasing 140 basis points versus the prior year quarter. The decrease in segment profitability was due to lower margins on ancillary services and operational disruptions in the Florida and Southeast regions related to Hurricane Dorian, coupled with an increase in selling, general and administrative expenses as a result of the absorption of acquired businesses, partially offset by the increase in revenue described above.

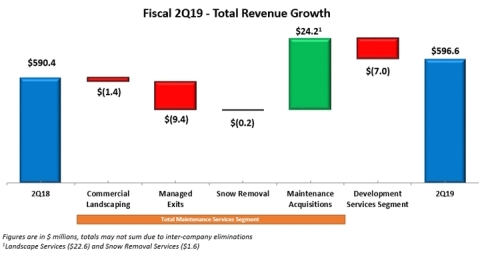

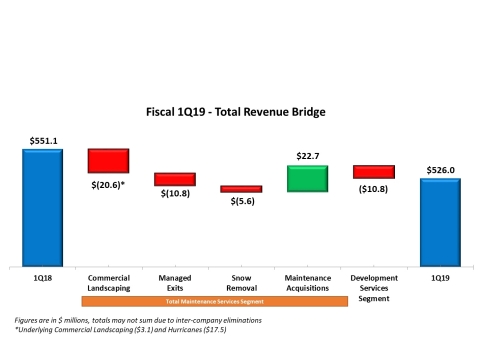

For the fiscal year ended September 30, 2019, revenue in the Maintenance Services Segment increased 2.2% to $1,813.4 million. Landscape Maintenance revenue increased 3.0%. Acquisitions added 5.2% but were offset by a 3.0% negative revenue contribution from commercial landscaping. Commercial landscaping revenue declined due to lower revenue related to the Company’s strategic Managed Exits initiative, a challenging revenue comparison with the prior-year’s hurricane clean-up services and lower revenue from snow removal services due to reduced year-over-year snowfall in key geographies. Excluding the negative impact of these episodic events, the Company’s underlying commercial landscaping revenue grew 0.6% for the full fiscal year.

Adjusted EBITDA for the Maintenance Services Segment for the fiscal year ended September 30, 2019 decreased 2.7% to $282.0 million, with the Adjusted EBITDA Margin decreasing 70 basis points versus the prior year period. The decrease in Segment Adjusted EBITDA Margin was due to the challenging comparison with prior year hurricane clean-up services, which typically contribute a higher gross margin compared with other landscape maintenance services, coupled with unfavorable weather conditions resulting in lower margins on ancillary services and snow removal services. The decrease was partially offset by more profitable contract maintenance revenue, the elimination of lower margin accounts through the Company’s strategic Managed Exits initiative and lower sales, general and administrative expenses as a percentage of revenue.

|

Development Services - Operating Highlights |

|||||||||||||||||||

|

|

|

Three Months Ended |

|

Fiscal Year Ended |

|||||||||||||||

|

($ in millions) |

|

2019 |

|

2018 |

|

Change |

|

2019 |

|

2018 |

|

Change |

|||||||

|

Revenue |

|

$ |

170.7 |

|

$ |

149.7 |

|

14.0% |

|

$ |

595.4 |

|

$ |

583.3 |

|

2.1% |

|||

|

Adjusted EBITDA |

|

$ |

26.7 |

|

$ |

23.4 |

|

14.1% |

|

$ |

81.7 |

|

$ |

78.7 |

|

3.8% |

|||

|

Adjusted EBITDA Margin |

|

|

15.7 |

% |

|

15.7 |

% |

0 bps |

|

|

13.7 |

% |

|

13.5 |

% |

20 bps |

|||

|

Capital Expenditures |

|

$ |

0.7 |

|

$ |

0.9 |

|

(22.2%) |

|

$ |

10.6 |

|

$ |

4.9 |

|

116.3% |

|||

Revenues for the Development Services Segment increased 14.0% to $170.7 million for the fourth quarter fiscal 2019. This was the highest revenue for the segment since BrightView was formed in 2014. Project revenue, derived from the segment’s revenue growth in key markets, and strong project pipeline drove the record result.

Adjusted EBITDA for the Development Services Segment increased 14.1% to $26.7 million in the quarter, positively affected by the increase in net revenue derived from the segment’s revenue growth in key markets and strong project pipeline coupled with revenue from acquisitions. Segment Adjusted EBITDA Margin was flat compared with the prior year period.

Revenues for the Development Services Segment increased 2.1% to $595.4 million for the fiscal year ended September 30, 2019. The increase in Development Services revenues was driven by the commencement of work on new projects, which more than offset a challenging comparison with revenue from the completion of certain large projects in the prior fiscal year, coupled with incremental revenue of $6.1 million related to development projects from the Maintenance Services acquisitions.

Adjusted EBITDA for the Development Services Segment increased 3.8% to $81.7 million during the fiscal year ended September 30, 2019. The increase in segment Adjusted EBITDA was primarily due to the increase in net service revenues described above and a more profitable project mix. Segment Adjusted EBITDA Margin increased 20 basis points to 13.7% in the fiscal year ended September 30, 2019 from 13.5% in the 2018 period.

|

Total BrightView Cash Flow Metrics |

|||||||||||

|

|

|

Fiscal Year Ended September 30, |

|||||||||

|

($ in millions) |

|

2019 |

|

|

2018 |

|

|

Change |

|||

|

Cash Provided by Operating Activities |

|

$ |

169.7 |

|

|

$ |

180.4 |

|

|

(5.9%) |

|

|

Free Cash Flow |

|

$ |

86.6 |

|

|

$ |

105.9 |

|

|

(18.2%) |

|

|

Capital Expenditures |

|

$ |

89.9 |

|

|

$ |

86.4 |

|

|

4.1% |

|

Net cash provided by operating activities for the fiscal year ended September 30, 2019 was $169.7 million, compared to $180.4 million for the prior year. The decrease was primarily due to an increase in accounts receivable due to the timing of collections, coupled with a decrease in unbilled and deferred revenue, partially offset by a decrease in prepaid income taxes and increases in accounts payable and accrued expenses.

Free Cash Flow for the fiscal year ended September 30, 2019 was $86.6 million, a decrease of $19.3 million versus prior year. The decrease in Free Cash Flow was due to the decrease in cash flows from operating activities of $10.7 million described above and an increase in capital expenditures of $3.5 million as well as a decrease in proceeds from sale of property and equipment of $5.2 million, each as described below.

For the fiscal year ended September 30, 2019, capital expenditures were $89.9 million, compared with $86.4 million last year. The prior year period included the purchase of legacy ValleyCrest facilities of $21.6. The Company also generated proceeds from the sale of property and equipment of $6.8 million and $12.0 million in fiscal 2019 and 2018, respectively. Net of the legacy asset purchase and the proceeds from the sale of property and equipment in each year, net capital expenditures represented 3.5% and 2.2% of revenue in fiscal 2019 and 2018, respectively.

|

Total BrightView Balance Sheet Metrics |

|||||||

|

($ in millions) |

|

September 30, |

September 30, |

||||

|

Total Financial Debt1 |

|

$ |

1,170.2 |

$ |

1,184.4 |

||

|

Total Cash & Equivalents |

|

$ |

39.1 |

$ |

35.2 |

||

|

Total Net Financial Debt2 to Adjusted EBITDA ratio |

|

3.7x |

3.8x |

||||

|

1Total Financial Debt includes total long-term debt, net of original issue discount, and capital lease obligations |

|||||||

|

2Total Net Financial Debt equals Total Financial Debt minus Total Cash & Equivalents |

As of September 30, 2019, the Company’s Total Net Financial Debt was $1,131.1 million, a decrease of $18.1 million compared to $1,149.2 million as of September 30, 2018. The Company’s Total Net Financial Debt to Adjusted EBITDA ratio was 3.7x as of September 30, 2019, compared with 3.8x as of September 30, 2018.

Recent Developments

Acquisition of Commercial Landscaping Company - Heaviland Enterprises, Inc.

In early November, BrightView acquired Heaviland Enterprises, Inc. (“Heaviland”), a top commercial landscape services provider in the greater San Diego, CA, market. Terms of the transaction were not disclosed.

Heaviland and its 150 skilled employees provide landscape maintenance, irrigation, enhancement and spray services. The company operates out of two primary facilities servicing a diverse portfolio of customers throughout San Diego County. Tom Heaviland, who founded the company with his late father Ron, will remain with BrightView along with senior leadership, to provide leadership continuity.

Acquisition of Commercial Landscaping Company – Clean Cut Lawns, LLC

In early November, BrightView acquired Clean Cut Lawns, LLC (“Clean Cut”), a leading commercial landscape services provider in Mesa, AZ. Terms of the transaction were not disclosed.

Clean Cut offers a full suite of commercial landscaping solutions, including grounds management, landscape enhancement, irrigation, arbor care and spray services. The company services its base of mostly HOA customers from one main facility and two strategically-located satellite sites. John Nation, principal, along with other senior managers, will remain with BrightView. By adding this experienced team of 110 trained and qualified field personnel, BrightView increases its strong presence in the greater Phoenix market.

2020 Fiscal Year Outlook

For the full year fiscal 2020, BrightView is providing the following guidance:

- Total Revenue of between $2,465 million and $2,525 million;

- Acquired Revenue of approximately $60 million over the course of the fiscal year;

- Adjusted EBITDA of between $312 million and $320 million;

- Net Capital Expenditures of 2.5% to 3.0% of revenue.

The Company is not providing a quantitative reconciliation of its financial outlook for Adjusted EBITDA to net income (loss), its corresponding GAAP measure, because the GAAP measure that is excluded from its non-GAAP financial outlook is difficult to reliably predict or estimate without unreasonable effort due to its dependence on future uncertainties, such as items discussed below under the heading “Non-GAAP Financial Measures.” Additionally, information that is currently not available to the Company could have a potentially unpredictable and potentially significant impact on its future GAAP financial results.

Conference Call Information

A conference call to discuss the fourth quarter fiscal 2019 financial results is scheduled for November 21, 2019, at 10 a.m. EST. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 4458518. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where presentation materials will be posted prior to the call.

A telephone replay will be available shortly after the broadcast through November 28, 2019, by dialing (800) 585-8367 from the U.S., and entering conference passcode 4458518. A replay of the audio webcast also will be archived on the Company’s investor website.